Gift Aid

You can create reports for Gift Aid transactions that meet the specifications for HMRC’s online submissions.

Note: HMRC limits submissions to 1000 transactions. If your period under submission has more than 1000 transactions, then prepare two or more reports for submission to HMRC. You can do this using Date from and Date to filters when making a New Claim for Donations report.

In order for a transaction to be included in your Gift Aid claim, you must:

|

1. Set the Gift Aid flag |

|

|

|

2. Add Gift Aid donor details |

Note: You don't have to select this flag for gift aid to work but it will make it visible on the Names list that the pupil has been marked for gift aid donation. |

|

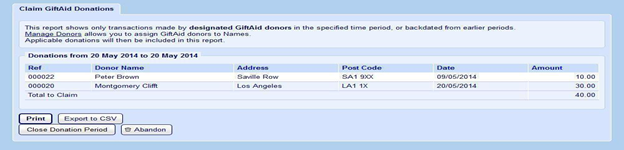

New Claim for Donations

Use this to generate a new Gift Aid claim report.

Note: HMRC limits submissions to 1000 transactions. If your period under submission has more than 1000 transactions, then prepare two or more reports for submission to HMRC. You can do this using Date from and Date to filters when making a New Claim for Donations report.

Enter the date you want to claim Gift Aid donation from. Enter the date you want to claim Gift Aid donations up to and click Preview Donations. This lets you view all transactions from eligible Gift Aid donors within the selected period.

Only transactions from pupils with a designated Gift Aid donor will appear in this report.

Note: If Gift Aid donors exist with incomplete information, you won't be able to claim gift aid for them. You can see which donors are missing information as these are greyed out in the report.

To manage Gift Aid status and donors, click the Manage Names link. Click the pupil’s name to bring up the Update Pupil screen and then select the Gift Aid tab to enter the gift aid donor information.

There is the option to Print, Export CSV or Close Donation Period at the bottom of the screen.

- If you choose Export CSV you can click on the downloaded file to open it.

- If you Close Donation Period, this finalises your submission and archives it to your Claim History.

Note: It is your responsibility to handle personal data in accordance with GDPR law.

Claim History

Use this to view previously submitted Gift Aid claims.

Click on the End Date link to view an archived report for the claim period in question.

There is the option to Print or Export CSV at the bottom of the screen.

- If you choose Export CSV you can click on the downloaded file to open it.

Note: It is your responsibility to handle personal data in accordance with GDPR law.

Backdated Gift Aid Claims

You can backdate eligible transactions that haven’t been included within a donation period that is now closed.

If you update the Gift Aid Donor details for a transaction that falls within a closed period it will be automatically included within your next submission.